A ceasefire has been agreed between Hamas and the Zionist entity, brokered by the US.

Palestinians in Gaza return to their homes.

But still, the Zionist entity controls most of the Palestinian lands with no guarantee that they will stop the displacement, including the ongoing military violence in the West Bank.

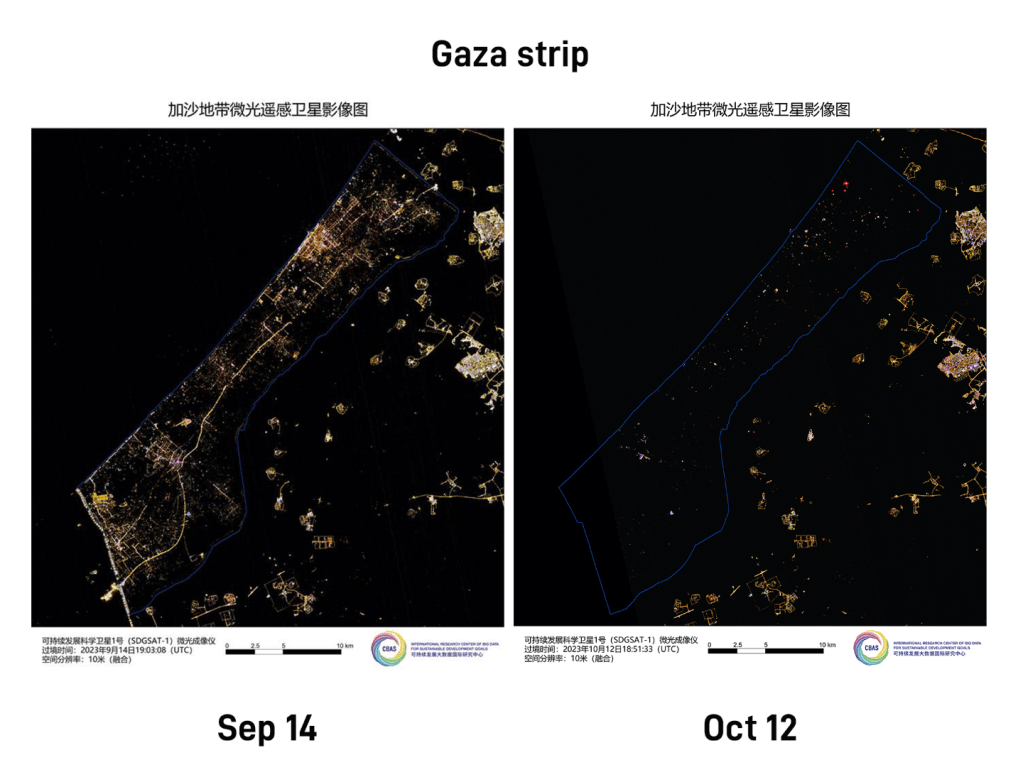

A Lancet study reported that by mid-2024, over 64,000 people—primarily women, children, and the elderly—had died from traumatic injuries in Gaza, with projections surpassing 70,000 by October. The recent report by Anadalo Agency in October 2025 said that over 17,000 students, 10,000 women, 20,000 children, 540 aid workers, and 254 journalists were reported killed. It has also been more than 77 years since the Nakba—the violent displacement and dispossession of 700,000 Palestinians from their land.

Those are not isolated tragedies; they represent an ongoing, systematic reality of genocide. International Association of Genocide Scholars, the UN Independent International Commission of Inquiry on the Occupied Palestinian Territory, Amnesty International, and other international bodies acknowledge that act.

In that case, we need to understand that many corporations are also directly, indirectly, or knowingly complicit in the genocide.

The War Economy Behind Sustainability Report

In June 2025, the Report of the Special Rapporteur on the situation of human rights in the Palestinian territories occupied since 1967 was published by the United Nations Human Rights Council, titled “FROM ECONOMY OF OCCUPATION TO ECONOMY OF GENOCIDE.”

The UN Special Rapporteur’s report reveals how corporate entities, across sectors and structures, are complicit in sustaining the Zionist entity occupation and apartheid economy.

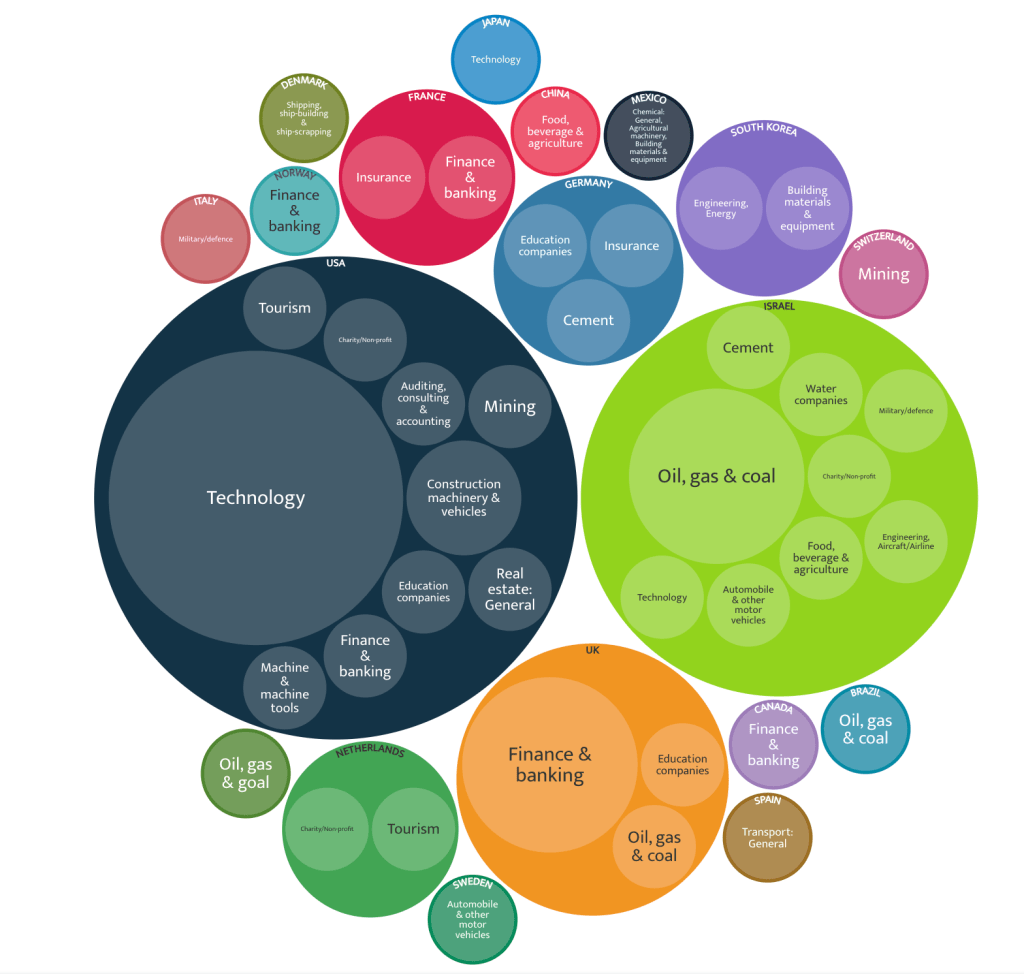

Their investigation mapped over 1,000 corporate entities potentially complicit in international crimes in occupied Palestine, spanning industries such as arms, surveillance, construction, logistics, and finance. Of these, over 45 companies were directly named for enabling and profiting from the occupation; only 15 responded to allegations. The report highlights how complex corporate structures, including parent firms, subsidiaries, franchises, and joint ventures, obscure accountability while sustaining a war economy that violates human rights and the sustainability of nature and human beings.

Ironically, some of them publicly champion sustainability and publish the ESG Report. That hypocrisy calls for a litmus test, not just for governments and institutions, but for corporations and, ultimately, for each of us as human beings.

Corporate Complicity in Genocide: The ESG Paradox

Palantir Technologies supplies AI targeting systems to the Israeli military and maintains a strategic partnership with its Ministry of Defense, while boasting of its ESG commitments. Maersk, a global logistics giant, has been found transporting weapons components to Israel, despite publishing human rights pledges in its ESG disclosures while denying the allegation. Google and Amazon, through Project Nimbus, provide AI and cloud services used for surveillance and military operations in Gaza. Microsoft delivers Azure infrastructure powering targeting systems responsible for thousands of civilian deaths.

These companies all release polished ESG reports, claim environmental leadership, and position themselves as ethical actors. But they fail the most fundamental test: Are you supplying the machinery of genocide? If the answer is yes, no sustainability claim can stand.

Their actions violate the Triple Bottom Line by harming people and planet, betray Stakeholder Theory by ignoring Palestinian lives, and expose a lack of supply chain traceability where ethics are conveniently omitted. This is the litmus test that cuts through public relations gloss and demands moral clarity.

Even Scholars Are Failing the Test

This litmus test applies to everyone, even scholars and climate advocates. I once engaged a professor of sustainability online on Twitter/X. He argued:

“It is very unwise if the climate movement aligns with Palestine. Climate and the Israel-Palestine issue are fundamentally different. I will publicly distance myself from them.”

I responded,

“Professor, really? War and colonialism in Palestine are environmental issues. Bombing Gaza, destroying farmland, poisoning water, these are not separate from climate justice. They are central to it. You should be ashamed, both as a scholar and a human being.”

Imperialism as the Common Root

What ties these actors together is a shared logic: dispossess for power, profit from destruction. The Zionist project continues to seize land for political and economic ends. Corporations reap wealth by supporting the machinery of war. This is not an anomaly. It is the very definition of colonialism in the 21st century, disguised under the banner of “innovation” and “green growth.”

So, Let’s Be Clear

Therefore, if your sustainability platform is complicit in genocide, it is not sustainable.

If your ESG report ignores environmental destruction from the genocide, it is not ethical. If your climate advocacy excludes Palestine, it is not justice.

This Is A Call

To my fellow scholars in sustainability: We must decolonize our frameworks and reclaim moral clarity. To ESG professionals: Trace your supply chains, not just for carbon footprint, but for blood.

To all: Demand accountability from the genocide supply chain and continue the boycott whenever possible of those who are complicit.

Free Palestine! Free the world from imperialism and colonialism!